Supports multiple invoice formats: When it comes to invoicing formats, every client has a different requirement (CSV, XML, EDI, PDF, etc.). This helps save costs, increase scalability, prevent you from missing payments, and achieve the best ROI possible. Automatically send and receive invoices: Most e-invoicing software allows you to send and receive invoices to your customers automatically. Unique Invoice Reference Number (IRN): It enables you to automatically generate an IRN from the government portal after you upload the invoice. Here are the key features of an e-invoicing system: While each e-invoicing software offers different features, the basic ones are the same. The customer will then receive the acknowledgment. You will then get validated, digitally signed invoices with the IRN. Enter your portal credentials in your e-invoice tool. Create API credentials for the GST portal for your e-invoice software. This will enable you to connect with the e-way bill system. Register your business in the e-invoice portal. You can generate e-invoices in just a few steps:

As a business owner, you won’t have to go through these steps to generate or share the invoice. However, all of this happens in the background.

The buyer will then get real-time visibility in GSTR-2A for confirming the ITC of the invoice uploaded by the company (you). Similarly, the GST system will also auto-populate the details in GSTR-1 and GSTR-2A. If the seller has all the details of the e-way bill (Part - A and Part - B) during the generation of the e-invoice, the e-way bill will be automatically generated. The invoice data is then transmitted to the e-way bill and GST system. #Electronic invoice software free code#

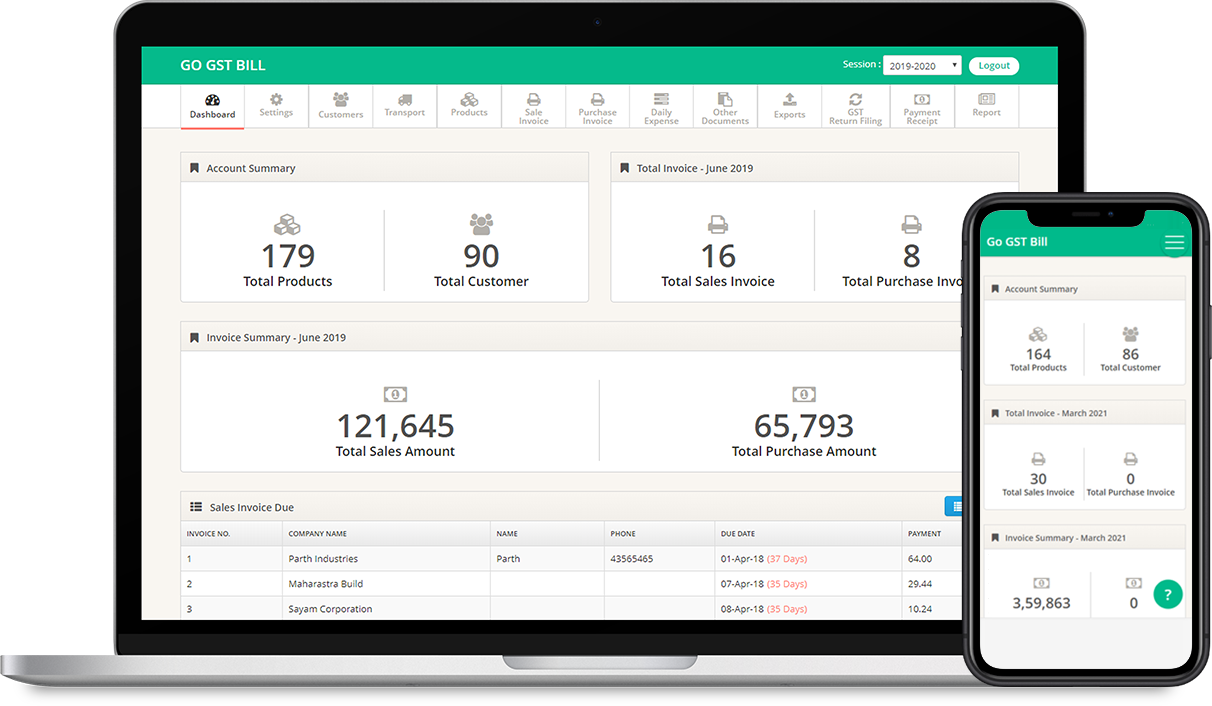

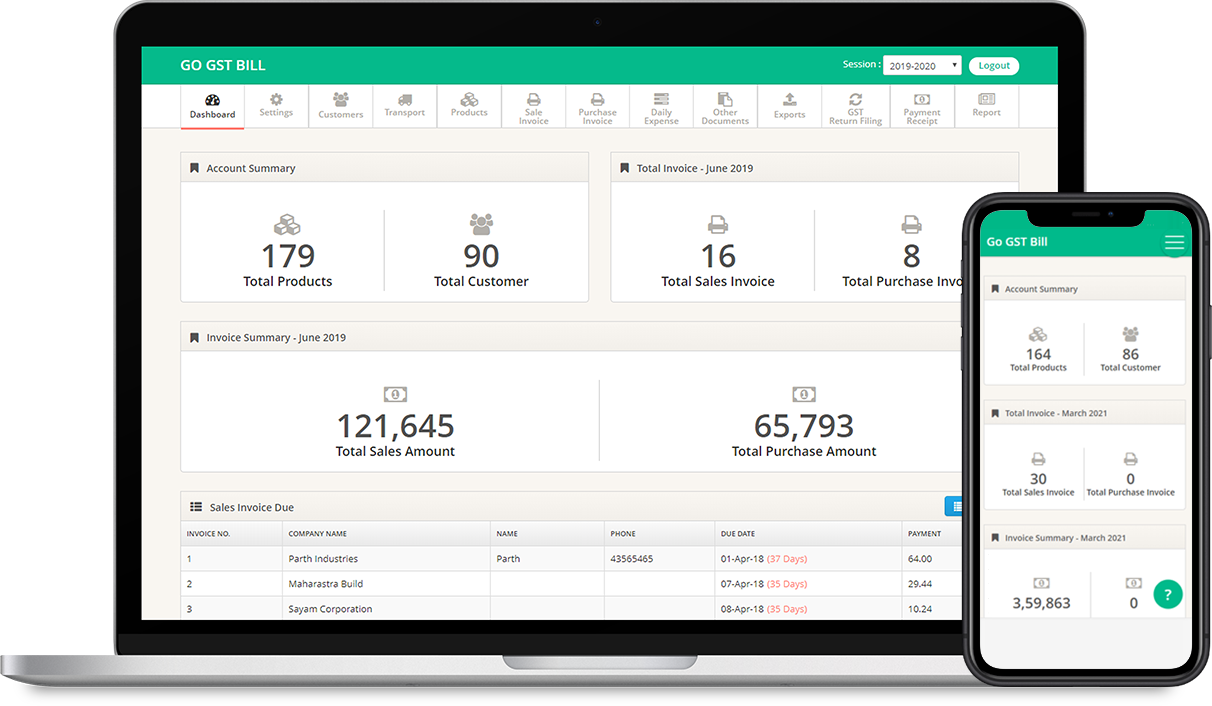

Once the invoice is validated, a QR code and an IRN (Invoice Reference Number) are generated. IRP validates the invoice generated by your e-invoicing software. The invoice is uploaded to the IRP automatically by your software. The company (you) generates the invoice using e-invoicing software. Now, let’s understand how the electronic invoicing system works. The second part consists of the GST/ e-way bill system and the buyer. The first part consists of the business and the IRP. The e-invoice system is categorized into two parts (as depicted in the below image). The buyer (the one receiving the invoice).  The business (the one creating the invoice),.

The business (the one creating the invoice),.

The key participants of e-invoicing include: To understand how e-invoicing software works, let’s first look at the parties involved. They also make it easier for you to adapt to changing GST requirements.Īdvanced e-invoicing tools also allow you to set your invoices on recurring mode so you can auto-charge customers and don’t miss any payment. The Central Board of Direct Taxes and Customs (CBIC) made the e-invoicing system mandatory for businesses with a turnover of more than ?50 crores from 1st April 2021.Į-invoicing software helps comply with government regulations, improves transparency, and is cost-effective. In the first phase, e-invoicing was made mandatory for companies with a turnover of more than ?500 crores on 1st October 2020. It went live in a phased manner, based on aggregate annual turnover (AATO). In GCC, e-invoicing was introduced last year (2020). Introduced in the GST software regime, e-invoicing specifies the invoice schema so that it can be read and operated by all the parties involved and accounting software uniformly. E-invoicing or electronic invoicing software is a system that enables businesses to create and approve invoices electronically.

0 kommentar(er)

0 kommentar(er)